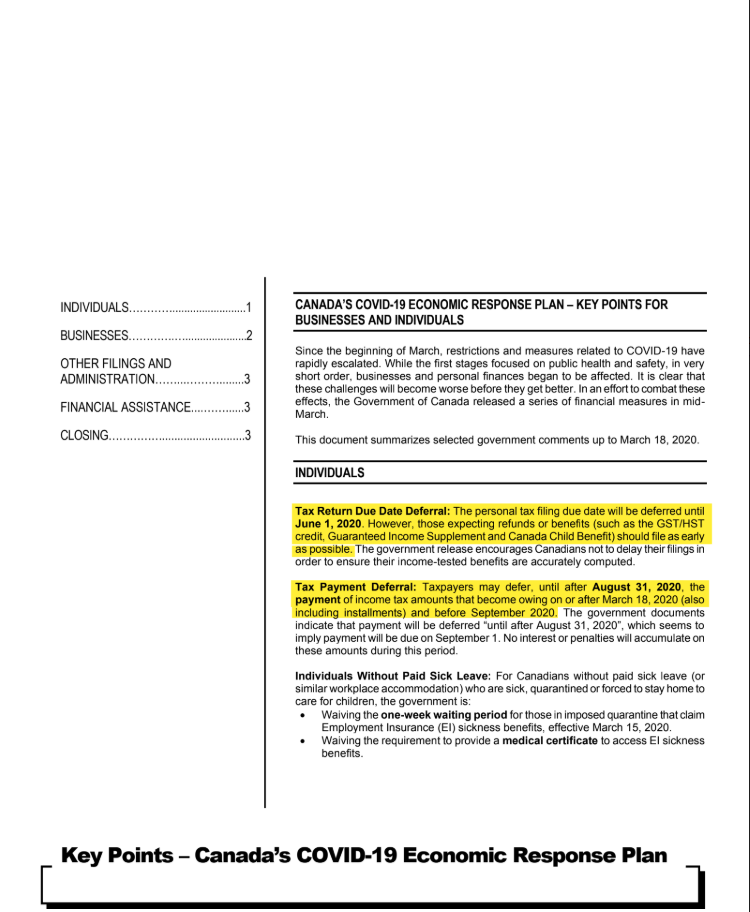

The Federal government has announced a number of measures to assist individuals and businesses through this pandemic. Below, you will find a very easy-to-read article by Investment Executive on how to access the various financial help offered; there is also an article by a tax service I subscribe to outlining the plans in more detail.

Here are the filing and tax deadlines only. Note that NOT EVERYTHING IS DEFERRED.

Individuals

If your tax return was due April 30th, your personal tax return must now be filed by June 1 (May 31 is a Sunday).

If you get a refund or are getting a family allowance, HST or Trillium benefits then you should file as soon as you can. Waiting to file into May could hurt you getting these amounts on time.

If you owe income tax personally – you now have until August 31, 2020, to pay this tax without interest charges. You can also defer your 2020 personal tax installments to September 15, 2020. But, be careful, it is still owed; so keep funds back. And, a late-filed tax return will still incur penalties on the unpaid tax.

Individual businesses and personal return – you are still required to file your personal return by June 15, 2020 – NO DEFERRAL. However, if you owe income tax, you have until August 31, 2020, to pay this tax, without interest. Remember, there is a late filing penalty and an unpaid tax penalty – these are not the same. Don’t confuse them.

Individual businesses and HST – NO DEFERRAL on either the filing or the payment. So, do not be late.

T1135 and Foreign property return – there was no mention of it by the Federal government. However, in general, it is due the same day as the tax return for that taxpayer is due. So, if there is a deferral then this will likely be deferred also.

Corporations

Filing deadlines – there is NO DEFERRAL on filing deadlines for anything that a corporation may be required to file – be it corporate tax return, HST return, payroll, elections, etc.

If you owe corporate tax and it was due after March 18, 2020 (ie for corporations with year ends of September 30th, 2019 or later) then you now have until August 31, 2020, to pay this tax without penalty.

Corporate tax installments for 2020 – these can be put on hold until September 2020, without the installment interest penalty. However, in September the installments are expected to be paid, so be careful to keep funds set aside.

Payroll remittances, HST remittances – these are still due – NO DEFERRAL.

HST and corporate tax filings – NO DEFERRAL. Do not be late with the filing of your HST or corporate tax returns. This means that accountants (including my practice) will continue to be very busy getting tax returns done and filed by the end of June 2020.

Other – Personal or Corporate Tax Installments for 2020

Installments are always based on the lesser of the prior year’s income or your current year’s income. If you know that your income is going to be down significantly for personal or corporate income, you are allowed to pay less or even no installments for 2020. We’d be happy to discuss this tax planning with you.

We all have this break of time. But the work still has to be done. So, take advantage of holding on to your money a bit longer but don’t delay your filing unless you have to.

Regards,

Ted Pollock

Supporting Documents

Click each image to read the PDF or even download it.